Are you taking full advantage of the tax-free allowance for your company’s celebrations?

Hosting a Christmas party isn’t just a festive way to reward your team; it also comes with tax benefits that can save your business money.

To qualify, your event must be a social function—like a Christmas party, summer BBQ, or even a virtual gathering—and open to all employees. The cost should be £150 or less per person. If your company has multiple locations, you can hold separate events at each site, provided all employees are invited. Different departments can also host their own parties as long as everyone is included.

These events are more than just fun—they’re a chance to strengthen team bonds, boost morale, and show your appreciation for your staff’s hard work throughout the year. However, keep in mind that events like retirement parties don’t qualify for the tax exemption.

For more details, visit the government’s website at www.gov.uk/expenses-benefits-social-functions-parties. The information here is accurate as of 21 August 2024, so be sure to check for any updates.

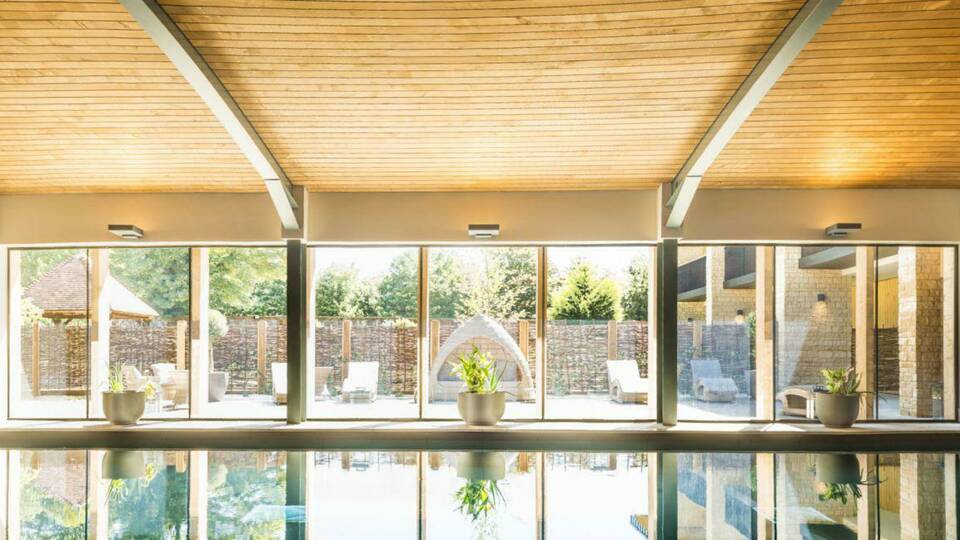

While planning, don’t forget to explore our Christmas party packages we offer at Rowton Hall Hotel & Spa. Our festive options are perfect for bringing your team together and making the most of these tax benefits. Celebrate in style, reward your employees, and strengthen company connections all at once!